Business Insurance in and around San Leandro

One of the top small business insurance companies in San Leandro, and beyond.

Helping insure small businesses since 1935

Business Insurance At A Great Value!

You may be feeling overwhelmed with running your small business and that you have to handle it all by yourself. State Farm agent Edwin Jasper, a fellow business owner, is aware of the responsibility on your shoulders and is here to help you get started on a policy that's right for your needs.

One of the top small business insurance companies in San Leandro, and beyond.

Helping insure small businesses since 1935

Cover Your Business Assets

Whether you are a psychologist a plumber, or you own a clothing store, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Edwin Jasper can help you discover coverage that's right for you and your business. Your business policy can cover things such as accounts receivable and business liability.

It's time to contact State Farm agent Edwin Jasper. You'll quickly observe why State Farm is the reliable name for small business insurance.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

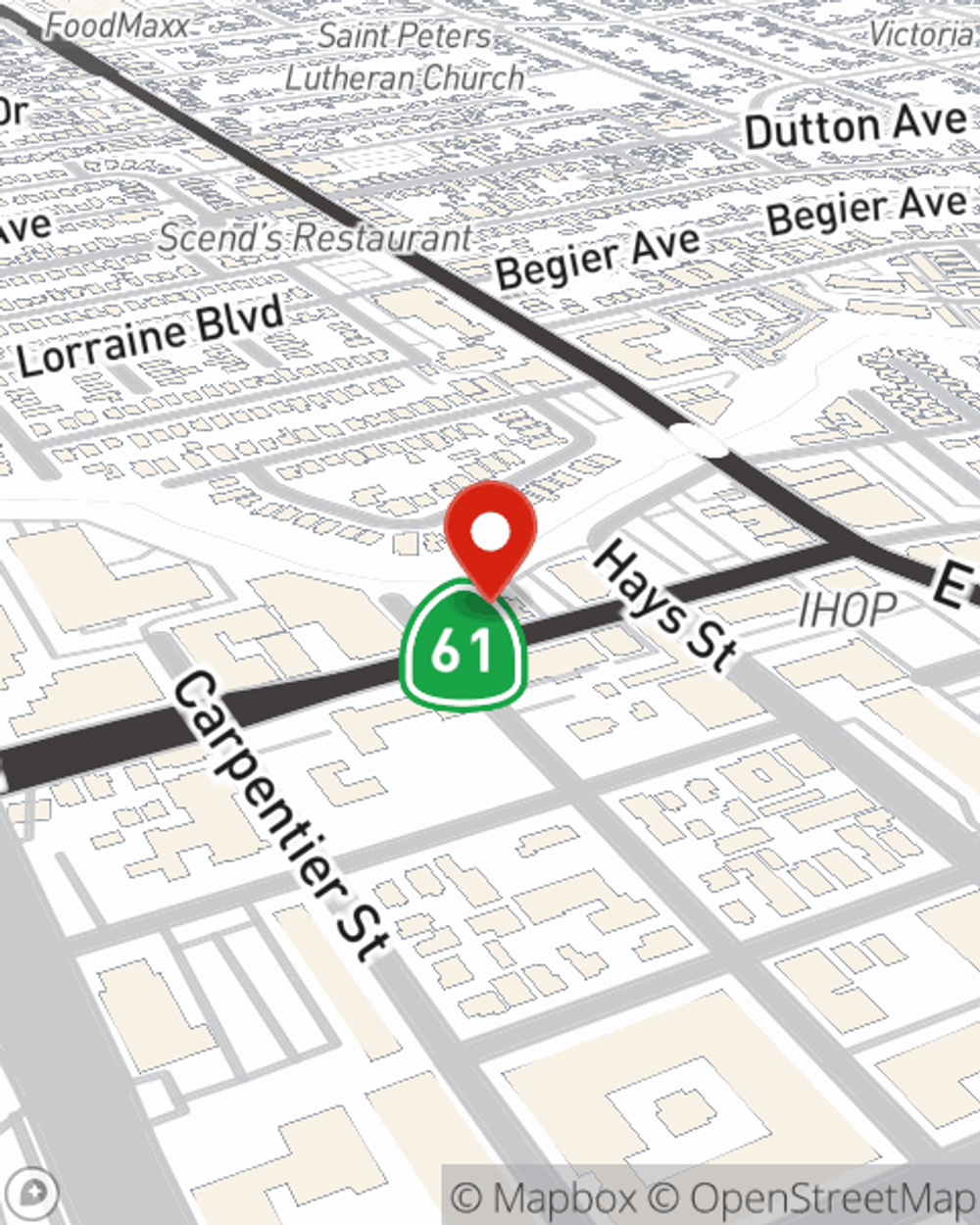

Edwin Jasper

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.